PayNearby Introduces a "Zero Investment" plan to honour Rural Women's Financial Independence

By: WE Staff | Saturday, 13 August 2022

PayNearby has announced the launch of a "zero investment plan" for women entrepreneurs at the last mile, encompassing more than 20,000 PIN codes, in honour of the nation's 75th Independence Day. This is a follow-up to its Pragati Mahotsav Independence Day campaign, which honoured the contributions of its retail partners.

By removing business account creation costs, this project hopes to accelerate the national ambition of financial inclusion for all while also empowering rural women in India to become active participants in the movement to build the country. By FY23–24, the company hopes to onboard 10 lakh or more women entrepreneurs.

The Women Sustainable Employment campaign, which has Sashakt Naari, Sashakt Samaaj, and Sashakt Desh at its core, aims to ensure that every household in India has a woman who is financially capable of taking care of her family and so creating an empowered community and an empowered nation. To create a more inclusive and sustainable society, PayNearby's "zidd" is to upskill all women and move them up the employment curve so that they may each equally contribute to the expansion of the economy.

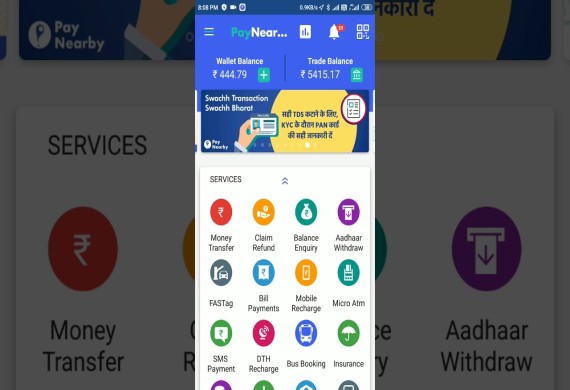

PayNearby aims to create an equal opportunity platform for them to advance and contribute to its One Nation One Service vision and move Bharat to the next level of growth and inclusion in the 75th year of India's Independence.

The cost of the Business Account, which is needed to set up and manage the account and is currently priced at Rs 1000, will be waived by the company in order to achieve this goal. However, the expense of completing the KYC will be kept to a minimal for female partners.

The corporation will launch a number of programmes in the coming months to empower society, of which this is just one. PayNearby hopes to collaborate with the nation's top banks very soon to offer last-mile SMEs and customers local savings and current bank accounts at a store close by.

This would guarantee that every household in the nation, including its women citizens, will have simple access to opening and managing a bank account, something essential to the last mile's financial stability. The firm is on a mission to increase its dedication to building a more inclusive and empowered country.

.jpg)