Know the difference between group and individual health insurance. Pick the one that fits your need

By: Johnson, Content Manager | Thursday, 14 July 2022

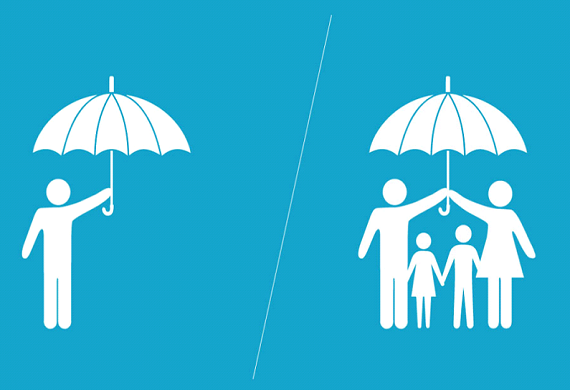

Insurance companies allow individuals to choose from several types of plans that best suit their needs. Two of the most popular policies in demand are a group or corporate health insurance and individual health insurance. To understand how these plans benefit an insured person, one should know how they differ from one another and who is eligible to obtain such policies.

Also Read - Women Must Live by the Motto 'Self Love First' for Enhanced Wellbeing

This article shows the key differences between these two policies, which might help an individual make an informed decision.

What is group health insurance?

A corporate or group health insurance plan provides medical coverage benefits to a group of people. For instance, this plan can benefit a group of employees and their family members. So, interested employers buy this plan from a provider for their organisation and offer health insurance benefits to the employees.

This plan comes with a number of benefits, such as:

● Employee satisfaction

● Health cover for those who cannot afford the premium

● There are no requirements for pre-medical screening

● Hassle-free claim settlement

Also Read - Are You Aware Of These Health & Wellness Mobile Apps For Women?

What is individual health insurance?

Individuals opting for this insurance plan can customise their plans per their needs and requirements. Unlike corporate health insurance, this plan requires a policy member to bear the premiums for coverage. Further, this insurance plan’s tenure depends on a provider. So, one can continue receiving benefits irrespective of employment, association etc.

There are some other lucrative benefits of such a plan. They are:

● Individuals with high health risks can benefit from this

● One can add parents and immediate family members

● Policy renewal without age restrictions

Key differences between the two

Before choosing an appropriate plan, an individual must consider the differences between corporate and individual health insurance. This way, one can get better coverage and maximum benefits on an insurance plan.

Also Read - Women leaders on How Menstruation Impacts Working Women & their Performance at Work

The key differences with respect to certain parameters are as follows:

● Insured member: In corporate health insurance, employees and their family members receive coverage benefits against medical contingencies. Alternatively, individual health policy covers medical bills of a policyholder only.

● Add-on options: Policy members of individual health insurance can include add-on covers against additional expenses. However, such options are not available for policyholders of group insurance plans.

● Claims: Corporate insurance claims are made through a third-party administrator, whereas individual health insurance claims can be made directly with the insurance company.

● Eligibility: One should be a permanent employee of an organisation to obtain benefits under a corporate insurance plan. There’s no such requirement in the case of individual health plans. Individuals can purchase plans as early as 18 years.

● Maternity benefits: Such benefits are available for policyholders of group insurance. However, a person with individual health insurance needs to purchase a separate maternity cover.

● Coverage for pre-existing diseases: Generally, insurers provide coverage for pre-existing diseases from the beginning of the tenure of a group insurance policy. However, individual health insurance policy members can enjoy pre-existing diseases covered only after a certain waiting period.

● Sum insured: Employees covered under a corporate insurance plan get a fixed sum insured as long as they work for the organisation. On the contrary, obtaining an individual health insurance policy allows a person to choose a higher sum insured as per their requirement.

Also Read - Nutrition & Mental Health in Working Women: Experts Explain the Connection

Which one should you opt for?

It is evident by now that both group and individual health insurance policies come with a distinct set of advantages. Learning about their differences helps an individual make a choice that is best suitable. Considering the premium aspect, a group or corporate insurance policy is much more affordable than an individual plan.

However, a person who prefers having full control over their insurance plan should opt for an individual plan. In the case of corporate insurance, there are fewer customisable options as a member’s employer pays the premium.

So, before making an informed decision, one should consider how group insurance differs from an individual plan. Further, it is important to list down the parameters that vary for each of these policies before individual plans to buy health insurance online or offline.